Canadian Purchase Tax Part 2: How To Use When The Vendor Has The Correct Tax Rate On Purchase Invoice

Photo by Jason Hafso on Unsplash

Now that we’ve seen the configurations of the Canadian tax rates, let’s dive into how to use these.

Vendor Cards

Tax Liable = TRUE

Sadly, setting the Tax Area Code doesn’t matter. Or at least in my version of BC, presetting it on the vendor card did not automatically pull through to the purchase document. Typically, here I would advise pre-set this Tax Area Code to what the vendor more commonly charges you for tax.

Business Central Vendor Card Setup

Purchase Invoices/Orders

In all of the below scenarios we’re going to assume that the vendor has invoiced us for the correct amount of tax.

What will hold true on all the below scenarios is that:

Tax Liable = TRUE

Use Tax = FALSE - which might seem awkward, but the Use Tax Flag does not work well with the Expense/Capitalize amount. The tax is already included in all the examples below, so we are not self-assessing tax.

Tax Area Code = what tax rate the vendor has used, be it BC, HST-13, or GST.

Nonrecoverable

Tax Group Code = Nonrecoverable

In this example we owe $560, that’s $500 for the supplies and $60 for British Columbia tax. The expectation here is that the full amount of $560 is going to go against AR due to the vendor, and the other side will hit the Income Statement for $560 to the used GL Account.

Business Central Nonrecoverable Canadian Use Tax Lines

Business Central G/L Entries for nonrecoverable use tax

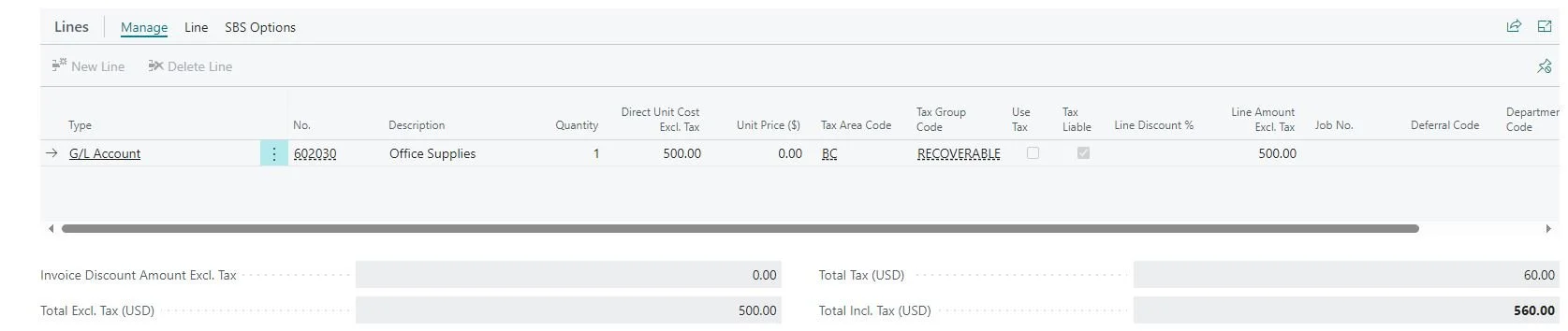

Recoverable

Tax Group Code = RECOVERABLE

In this example, we owe $560, which is $500 for the supplies and $60 for GST+ British Columbia tax. The idea here is we want to pay the vendor the full $560 but only have $535 hit our Income Statement for the supplies and PST Tax, and the recoverable GST tax to go to our sales tax accrual account as a credit (a refund). Note: the nonrecoverable portion (the PST) will not show an accrual. You could make your PST/GST accrual accounts different, though note that if you use Avalara, this will only map to one account.

Note: If the example was QST or HST that did allow recoverability we would expect a separation of the GST and HST tax and both going to the balance sheet. The expected result would be $500 for supplies, and the tax would be separated between the two agencies on the Balance Sheet.

Business Central Recoverable Use Tax Lines

Business Central Recoverable Use Tax G/L Entries, separating the GST/PST into two lines

Example Entries for Quebec where both GST and the QST are recoverable

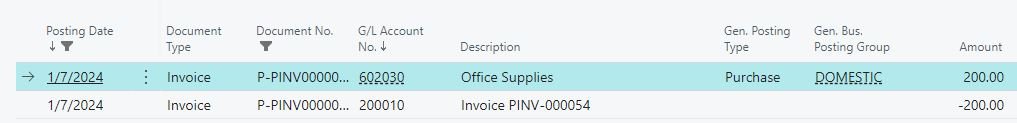

Meals -50% Recoverable

Tax Group Code = MEALS

In this case, the amount is $200 for the meal, $24 for taxes - 100% of the PST tax and 50% of the GST tax is going to go to our Income Statement and the other 50% of GST is going to go to our Balance Sheet Sales Tax Accrual account.

Business Central Canadian Use Tax Meals 50% recoverable line

Business Central Canadian Use Tax Meals 50% GST recoverable G/L Entries. Notice the split of GST for 50% and that the meals expense account is 50% of the tax amount.

Exempt

If what you are purchasing is exempt, and you have not had sales tax applied. For example, they have invoiced only $200 for supplies.

Tax Area Code = EXEMPT

Tax Group Code = NT

This will result in no tax showing up on the Total Tax, nor accruing any tax, even if using Avalara for use tax.

Business Central Exempt Lines

Business Central Exempt G/L Entries

In Part 3, we will discuss how to do these if the amounts are incorrect.