Oh, Canada! Canadian Use Tax Setup in Business Central

Photo by Guillaume Jaillet on Unsplash

I noticed each time anyone speaks about sales/use tax setups in Business Central it’s dominated by US tax laws. This is fine, until you realize that Canadian tax laws are not the same, and we have all left you out of the party Canada. Well, not today, Canada, I got you.

Tax Group Codes

First, let’s talk about Tax Group Codes. Why? Because you’re kind of weird. I won’t pretend I know when to use these terms, so for that, you’re on your own.

The four tax group codes, as far as I can tell, you need in Canada are:

NonRecoverable - 0% recoverability

Recoverable - 100% recoverable. Why? I don’t know. When? Also, I don’t know. Though I do know GST/HST and QST are recoverable vs a PST.

Meals - which is 50% recoverable

NT (Nontaxable; I use NT because that code works best with Avalara for nontaxable)

Bonus Tax Groups for the Sales Tax Side:

TAXABLE - this is more if you use sales tax and the sales tax software holds the key, or just everything is Taxable.

Custom Tax Group codes, like PP052301 (Pet Shampoo, medicated without a prescription) - aren’t these fun? So fun.

Tax Group Setups with an extra Nontaxable in there

Tax Jurisdictions

For Canada, there are a few primary tax jurisdictions.

GST - this is due to the CRA and is the national tax

PST - Provincial Sales Tax - which is for Quebec, British Columbia, and a few others.

HST - Harmonized Sales Tax (which oddly is also associated with provinces, but I’m not here to split hairs). For this, there are two 13% and 15%

You can find tax rates/combined rates here: Sales Tax Rates by Province in Canada | Retail Council of Canada

You’ll want a few different categories on these, ones you expect like:

GST

HST-13

HST-15

PST-BC

PST-MB

But the weird one, in my humble opinion: You need to set up ones for 50% meals, so you’ll see I have GST and then GSTNT. I didn’t go through and do all the regions where you would want to set up any other tax that allow a 50% meal recoverability.

Notice a few things from my screenshot:

The accounts are all liability accounts; this, for me, is a Sales Tax Accrual account.

Each one reports to its jurisdiction, which is essential - in Canada, these taxes are due to different entities

Country/Region type is set to CA. THIS IS IMPORTANT! Also, it is highly annoying when you get further down the road and forget to do it in one place.

I also had two separate setups, so please don’t get confused between screenshots that might say PST-BC vs ones that say CABC, same concept, just different localizations ended up with different naming.

Business Central Canadian Tax Jursidictions

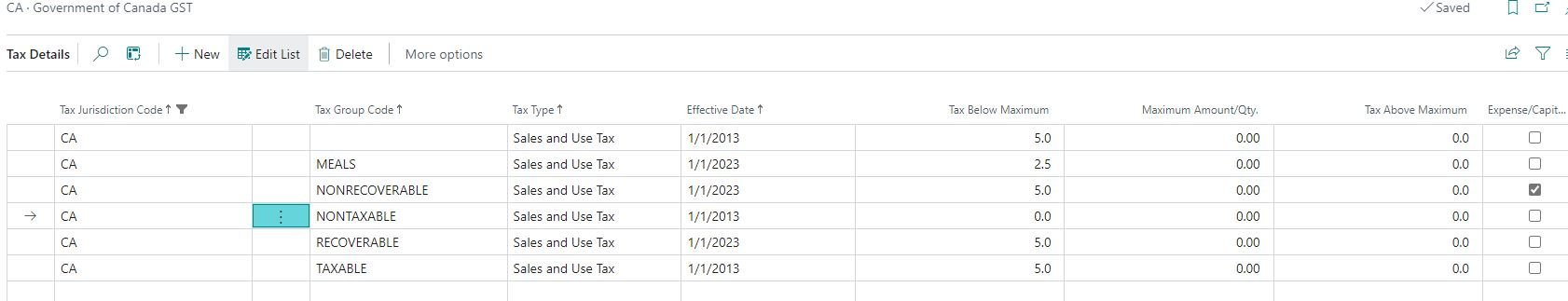

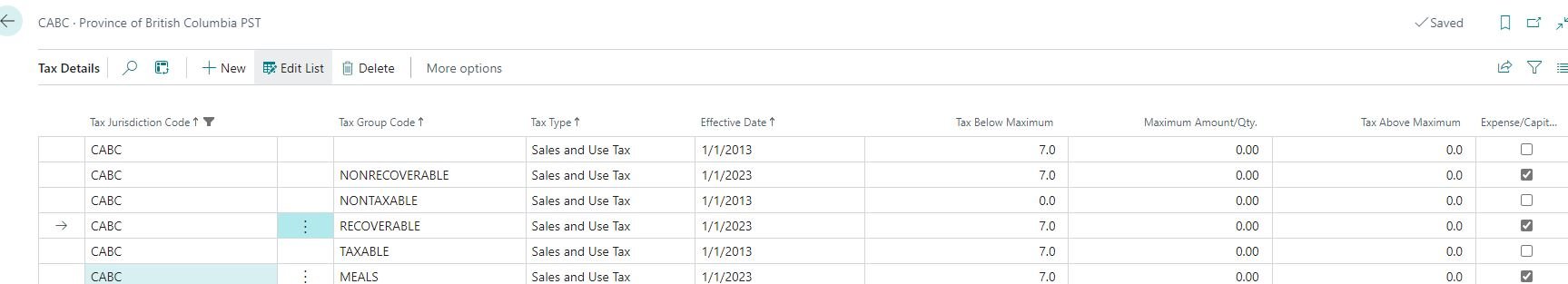

Tax Details

Now, for the Tax Details section, you’ll need three lines on each one of the regular ones (so not the special PSTBCNT):

Recoverable - set to the full tax rate, but do not hit Expense

NonRecoverable - set to the full tax rate but hit the Expense

Meals - set to 50% of the tax rate for GST; also do not Expense

What is this Expense/Capitalize button?

If you hit this button, the tax will be expensed on your income statement, in most cases, to the same account as what’s being purchased.

If you don’t hit this button, the tax will go to your Balance Sheet in the account on the Tax Jurisdictions setup.

There may be a mix on recoverable and nonrecoverable, example for PST tax the PST portion for Recoverable is Expensed, while the GST would not be.

Business Central GST Canada Tax Detail Setup

Business Central BC PST tax recoverable also being set to expense as you cannot recover the PST tax

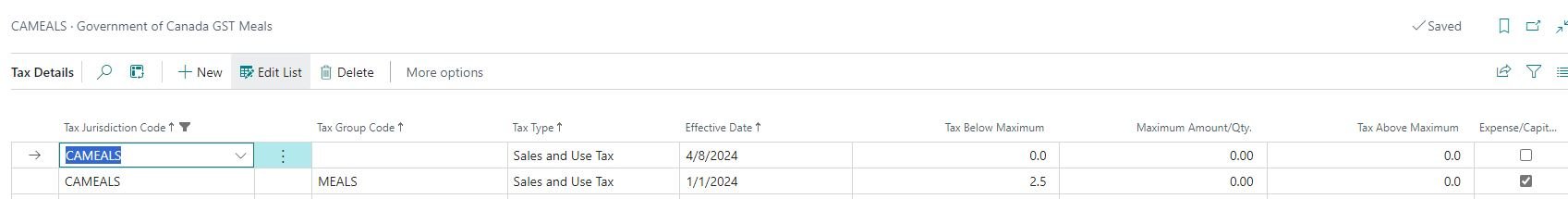

For the GST or the other ones designed for meals, you’re only looking at putting in: Meals

50% of the real rate

Expense is True

The idea is that you’re setting up the 50% expense part and the 50% recoverable/going to your accrual account part. It doesn’t matter if CAMEALS or CA is marked Expense and the one is not, as long as only one is set to True and the other is not.

Business Central Canada Tax Detail Setup - 50% Meals

Tax Areas

Next, you’ll want to set up your Tax Areas; most should align with your Tax Groups. Such as a GST, HST-13, HST-15, QC, and SK.

This is where you bring the rates together, like Quebec needing its GST+QST tax or SK GST+PST-SK.

Just make sure you select Region Code of CA.

For the Meals, you’ll bring together a few elements, which in my scenario is:

CA

CAMEALS

CABC

When this is combined with the Tax Group: MEALS the GST rate is a half rates while PST is the full rate and not recoverable.

Business Central Canada 50% PST Meals Tax Area

In the next section of Tales of “Things I Failed So You Don’t Have To,” we’ll talk about how all of these come together. If you’re like Andrea, I have Avalara. Do I need to do all of this? Yes….yes, you do. You cannot escape this.