Canadian Purchase Tax US Localization Part 3: When The Tax Is Incorrect

Photo by sebastiaan stam on Unsplash

This is for the US Localization, if you are on the CAN Localization See Part 5 instead.

In the US

Not to compare everything to the US, but we can first discuss expected vs what Canada does…because I will be honest: Canada doesn’t work as expected.

First, in the US, we wouldn’t use the use tax/purchase tax module unless we assess the Use Tax on ourselves. Which could be in full or in part and isn’t always required (it is complicated). Whenever someone tries to use the use tax without the Use Tax flag, it’s gone so wrong. So either the vendor has charged tax, or you self-assess tax.

Second, the setup on the purchase document if you’re self-assessing is:

Tax Liable = True

Use Tax = True

Tax Area Code (on the header, not the lines, but will populate to the lines) = The taxing jurisdiction or a variance jurisdiction. The variance comes in when someone has charged the wrong tax, like they charged the State tax but not the city tax.

Tax Group Code = what was set up for use tax; I like “Supplies.”

Then, the transaction more or less applies tax and expenses out to the same GL account as whatever you’re hitting (like a supplies account), and the vendor is due the amount minus the tax.

In Canada

You must use the module every time, but the big thing is the Use Tax Flag in Part 2 was set to False/not checked. The Tax Area Code was the tax the vendor applied, and we paid the vendor for the tax they invoiced.

Now, what happens when the vendor has not charged us the proper tax, and we must flip the Use Tax Flag on:

Recoverable

This actually works, and the entries are much the same as we saw in Part 2, except in this case, the vendor is only paid the $200, office supplies take the full burden of both sides, and the two taxes GST/PST are split up and posted to the Sales Tax Accrual account. Please note, I do know PST is not recoverable, but to demo what does work I turned this to not expense.

This means for recoverable tax, you can assess it on yourself…but notice this is ONLY for a non-tax situation; i.e., this vendor didn’t charge tax.

Recoverable CA Use Tax Line Setup

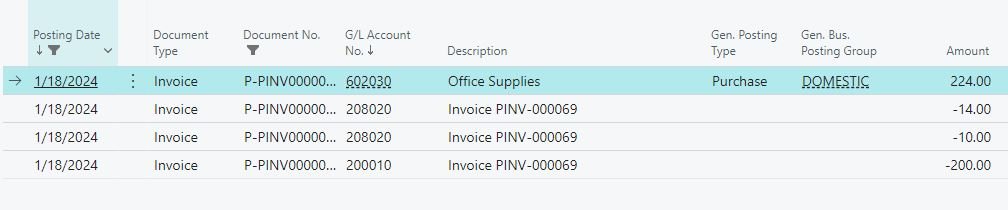

Recoverable CA Use Tax GL Entries

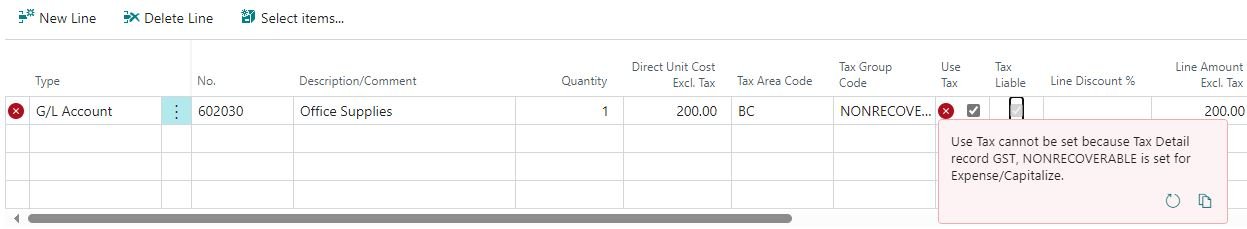

NonRecoverable/50% Recoverable (Meals)

Sadly, it doesn’t work; you’ll get an error. Microsoft doesn’t want you to use the use tax flag and the capitalize flag.

What about Tax Differences?

In the US, as mentioned, we set up a different account, vendor charges rate 1, and we self-assess the 2nd tax forgotten (like state vs city). You can’t do that here in Canada, otherwise, your other necessary transactions at least for the working recoverable disappear. If a vendor just charges GST and not PST, I cannot follow the rest of the flow and have a GST go to the vendor and PST not to the vendor, at least out of Business Central out of the box. You must report all sides, while in the US we don’t, we just report on what was missed. Now, in the US, if we get audited, we should in some way have the tax split apart like a GL line to represent the vendor-paid portion of the tax, just to keep your sanity in an audit.

Why doesn’t this work? I’m not sure; I couldn’t think of an explanation for why the capitalizing ones don’t work or how you could split the tax.

Avalara Solution

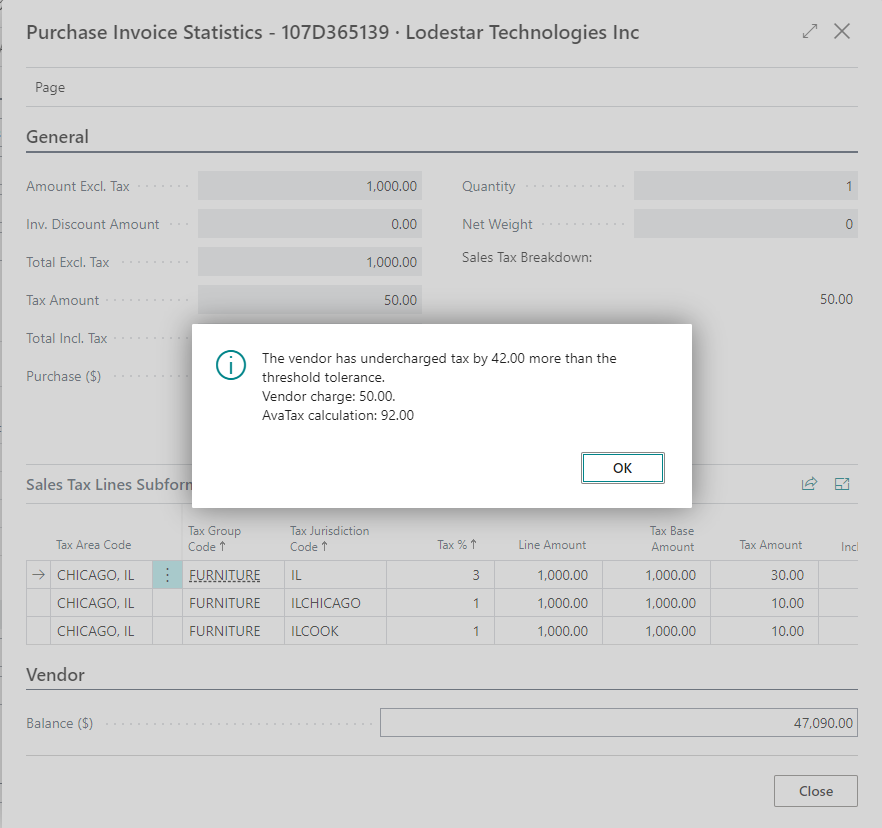

Avalara does have a solution for this; their use of tax modules does work decently well for this issue. You keep all BC setups you already have (Part 1), like tax areas/tax groups, but now Avalara at least will ask you if you want to add this missing tax. For example, if the vendor only puts GST on, you would select GST for your Tax Area Code, but Avalara, knowing your location, will know PST should be applied.

Avalara Canadian Purchase Tax Error

Then, once you go to Post, it will ask you if you want to accrue this, which is important because maybe GST was the only tax. It will then flow through like you would expect for your GL entries and make its way to your return.

This is awesome for those undercharge scenarios, and without selling myself out to Avalara, I can honestly say I don’t know how one could operate in Canada with Business Central without using Avalara. I think your only fallback would be some manual work or getting the vendor to change their tax for you.

Avalara Canada GL Entries on a Nonrecoverable Tax Group Code where the vendor has charged GST

Where Avalara Fails

Sorry, Avalara, but you did miss a few steps as well, at least at the time of writing this:

Avalara is based only on your location code, so if you operate in British Columbia but the tax you’re looking for is Ontario, this isn’t going to help. On sales tax, Avalara looks for the location where this is being sent to determine tax, while on purchase, it's the same thing (it’s being sent to your location), but it seems only to be looking at location setups in Avalara. VS the address being sent over to Avalara. Drop-ship or travel around that location code isn’t going to register, nor does it care about your Tax Area Code names. Or at least, I couldn’t find how to get Avalara to understand I was looking for a rate outside of my primary location of British Columbia.

Avalara still followed the rules with NT tax group codes not applying tax but did not understand the Tax Exemption Number field being populated to mean this order is exempt or in some way partially exempt.

It doesn’t care if you are over-taxed

I tried to change my British Columbia rate up, it was 7.5% vs 7%, one time I got an indexing error and the document refused to post. However, when I went to capture that error screenshot, the error stopped, and the document was posted without issue and at the incorrect rate.

I changed to HST-15% with all British Columbia addresses, which should be wrong; no error was given, and the invoice was posted.

If you’re exempt and use NT but still have tax applied, it still doesn’t care. It allows it to post without issue.

Now, even with that, I will still stand by the comment that Business Central can not fully handle Canadian tax when there’s an issue with the tax the vendor charged, and a tax software will most likely be your best route - or at least on the purchase document itself automatically. See Part 5 for the work around.