CO Delivery Fee in Business Central

CO Law

First, I want to state laws change, as the CO law recently did change in a few key ways for 2024. Any advice below is meant to help you with compliance, however this is not to be considered legal advice.

What does the law entail:

Starting in 2024 a $0.28 fee on orders that are delivered to the final consumer in Colorado. The law was passed to more or less help pay for the highway system in CO.

Business making under $500K in annual retail sales in CO are exempt from the fee.

The fee can be imposed on B2B sales if the business is the final consumer of the goods. Think a computer store selling to a company and delivering to them. However, in general, the sale must be taxable to have the fee imposed.

It’s one fee per order, not per item; if it ships in multiple orders than one fee per shipped order.

It used to be that the consumer MUST see this on their invoice, and they must pay it - recent law change now says that the vendor could just absorb the cost. It’s up to you as a business decided if the fee per order is just a cost of doing business or if you want to pass on to the consumer.

File on a separate return, form DR 1786 due to the CDOR.

Avalara?

To date I haven’t seen that Avalara is handling this fee for Business Central. Now this is subject to change as the connectors improve and this becomes more common place. Which by the way, this will become more common place.

Ecommerce Site?

Honestly, if you’re dealing with an ecommerce site, this should be imposing the delivery fee. Shopify does have a way - then you just want this line to pass through on the order into BC, which will accrue this into your balance sheet. You shouldn’t need to add this onto an order in BC unless the plan is for you to absorb the cost.

Business Central CO Delivery Fee how lines should look coming from the website that passed the charge to the consumer

How to Handle In BC

Passing on to the Consumer

First, I would setup a new Liability Balance Sheet account - I would not mix this with my Sales Tax. It’s a different government form and I think combining them would make anyone go insane. That’s true even if the website is doing the pass down on the fee.

BC Sales Tax functions aren’t really equipped to handle this flat fee, that goes on top of a tax rate. Nor will Avalara do this for you.

I think the best way to handle this is going to be:

1) Make a resource for the Delivery Fee, that links out to the posting of the accrual account - this will help you track this overall.

Just make sure this is not taxable, this should be NT or some other form of no tax on the invoice

The price is set on the resource card, put the $0.28 here vs on the next step

2) Make a Recurring Sales Line to pull in the Resource

3) Apply the Recurring Sales Lines to any customers that typically qualify for the fee and set to Always Add

You may need to add on to other recurring sales lines if you use these heavily

CO Delivery Fee Business Central Recurring Sales Lines

Business Central Sales Lines with Delivery Fee

Not Passing On To The Consumer

You have two choices here:

1) The recommended approach: At month end have a count of orders that were shipped in CO to consumers and make a top side entry

Accrued CO Delivery Fee Tax account or whichever BS account this is being paid out of

Expense on your Income Statement

Just be sure to record and attach the backup in case of an audit.

Business Central CO Delivery Fee Top Side Entry

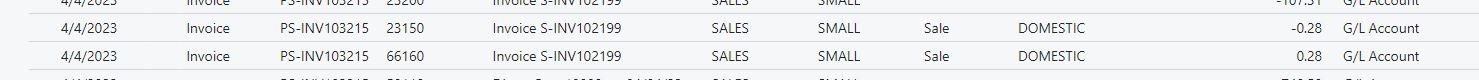

2) The steps above for passing on to the customer, except, you also add a negative line item; which could be a second resource or a GL account - you want the second account because in the first one we just put this against the accrual; the second line is for the expense. I will say it does look odd the accrual is positive and the expense is the negative line, but I promise it works out in the end.

Now, of course, this will show on the customer’s invoice if you generate invoices out of BC.

Business Central CO Delivery Fee Cost Absorption (old fee of $.27 entered here)

Business Central CO Delivery Fee Cost Absorption G/L Entries

Hopefully in the future this will be more accommodated either via BC or via Avalara, but since it’s only one and maybe a second state it’s probably not going to be widely addressed - more so with an easy work around.