Canadian Purchase Tax Part 4: Continia Expense Managment

Image From Continia Expense Management | LinkedIn with a little maple leaf added to make it Canadian

I have some very exciting news that is hot off the press! Continia Expense Management for BC 23 in an up and coming release will be able to handle Canadian Purchase Tax!

Previously, Continia Expense Management:

Didn’t use the Tax tables, thus wasn’t really doing anything for the tax

Didn’t really care about your 50% recoverable meal tax

Would start with the final dollar and try to back its way into the tax that was calculated, which didn’t always hit the nail on the head

There was a bit of a work around which was to put it on a Purchase Invoice vs on a General Journal

What’s New

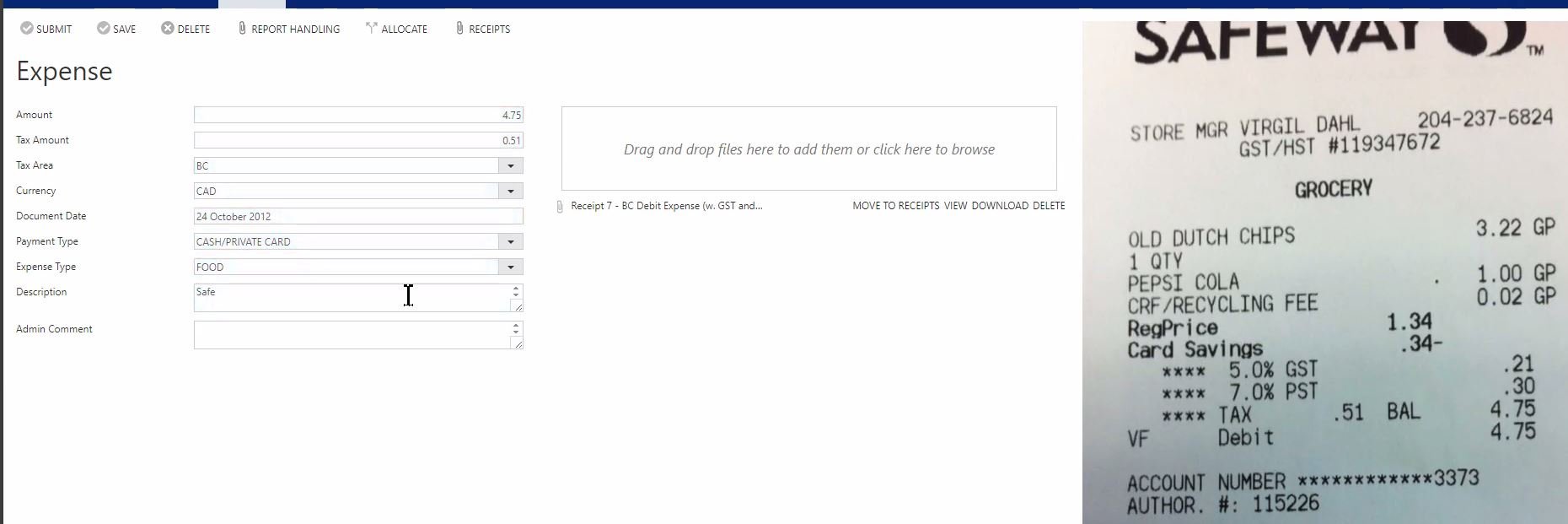

Now on the Mobile app or online platform while entering the expense there is a few new fields, or a few optional add in fields. The OCR will try to see what Tax Area and Tax Amount was used on the receipt. The Tax Areas are coming in from BC Tax Area fields. The user would capture and submit the expense with the new tax fields.

Continia App with Tax Amount/Tax Area

Configured Fields

In Business Central an admin can define things like if Tax Group Code should also display. Which if you’re following along at home with me, would be recoverable, nonrecoverable and meals.

Continia Expense Mgmt Configure Fields

Posting Setup

The admin can also add on which Tax Group Code is the primary, adding that Meals onto your Meal G/L Account.

Continia Expense Mgmt Posting Setup

Posting Expense

Now you can post the expense using a General Journal as the tax will follow the tax setups in BC. 50% recoverable, or non-recoverable it will follow the same path as if you were using the tax rates in Part 2. Just like with a Purchase Invoice, this could mean all of the lines are expensed to one GL with no split out, have a split out for a GST/PST tax or PST 50% capitalized/ 50% recoverable & GST capitalized.

Not to mention, you no longer have to allocate the expense either for the tax; and it will hit your tax tables for you to file with. Now how this will play with my favorite tax software Avalara, I’m not sure, nor are these purchase invoices. If anyone has both updated let me know!

Bonus it even works with the allocation and splitting out tax.

Continia Expense Mgmt Approval Screen for Canadian Tax

Continia Expense Mgmt Allocation

Continia Expense Mgmt with Allocated Expenses G/L

What a great improvement to the Continia Expense Management platform! Canada, you have been forgotten no more! You can read about this and other up and coming Continia changes here.