Canadian Depreciation Book for CRA on Fixed Assets in Business Central

Just when you thought we were done with Canada, we’re not! Time to talk about Fixed Assets!

Now if you’re just in Canada and not also bound by GAAP this will still be helpful but the intent is those variances between US GAAP requirements and the Canadian CRA requirements. This isn’t much different than people who keep separate Company/Reporting/Financial deprecation books verse tax books. In the US this normally referred to as 179 deprecation for the IRS, or we might keep assets on the Fixed Asset screen for PPT tax but are not reporting assets.

Setting Up The Depreciation Book

In Business Central (BC) go to: Deprecation Book

Standard straight-line GAAP deprecation has a book called Company or Financial; we’re going to create a new one for tax. For mine I’m going to call it TAX. However, if you are dealing with both US Tax and Canadian Tax in one book of business you might want to specify.

The most important part: Ensure all Integrations are OFF! This will allow you to run this book of deprecation, track assets in this manner but not impact your General Ledger. Your primary GAAP deprecation book should be set as primary and have the integrations on.

Business Central Tax Book of Business Deprecation Book

Deprecation Tables

Next, we want to setup the Deprecation Tables. When someone is using straight-line they normally don’t touch these. In this case, we’re going to want to set these up to follow the CRA schedules.

I did interpreted the CRA to be annual, so once it’s gone it’s gone. I.e. a Class 44 asset of 25% is 4 years, it’s 25% per year and then it’s fully depreciated for tax purposes. Please let me know if this is wrong, and I’m not a Canadian Tax Legal expert so the Business Central part works but you may need to consult with a tax attorney or the CRA for proper application.

Business Central Depreciation Table Card

Fixed Asset Card

Set up the fixed asset card like you normally would, the description, class code and a matching Posting Group. The first deprecation book code should be the Company/Financial one - this is the one that actually directs where this will post on your Financials.

Business Central Fixed Asset Card

Then select: Add More Deprecation Books

Most likely if it’s your first time will need to personalize the screen to add Deprecation Table Code in.

Business Central Fixed Asset Deprecation Book Lines

Acquiring The Asset

Acquire the asset like normal, on a purchase document or a FA G/L Journal if it was coded already to an account. This acquisition is against the main Deprecation book, the company book.

However, now you need to get the value into the Tax Book; here you’re going to use the Fixed Asset Journal. This is a one sided subledger only build, it only works if the GL integration is off, which is true for this book of business.

This is very important as well when the asset can’t be fully capitalized for Canada that are under 10.1 Class, you cannot take the full value of the tax while GAAP does allow you to take the full value as a capitalized asset. So here you can deviate your tax book from your company book even on acquisition value.

Business Central Fixed Asset Journal

Business Central Fixed Asset card after acquisition

Calculating Deprecation

You should now be able to run deprecation monthly for your Company book of deprecation (or however often you do run this); and then you can run again for your Tax book of deprecation - this should co-inside with your CRA reporting requirements for the asset.

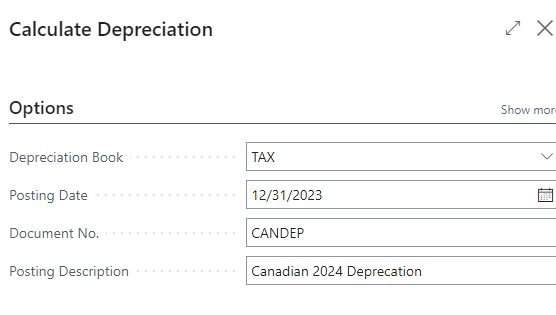

Business Central Calculate Deprecation

Reporting

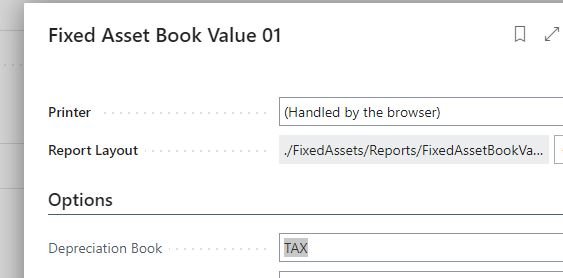

The report can be found Fixed Asset Book Value 01 switching over to Deprecation Book: Tax; I normally sort on FA Subclass as my subclasses are normally a 1:1 to the Balance Sheet to make an easy reconciliation. For Tax book that sort of helps, but sadly, there’s no sort on Deprecation Table Code as that would be amazing.

Fixed Asset Book Value 01 Business Central

Side note: I do realize I miss-classed and miss-named “Chompy”; its feeling are extremely hurt as it knows it’s Warehouse Equipment a Class 8 Asset, but Class 10.1 has weird things with tax so I choose to use that as the example. Also, if you are coding to Class 10.1 and you name every card Box Truck, I have bad news, that’s a terrible name - please be descriptive with your Fixed Asset Description, it makes your audits so much easier or when someone sales the assets a lot easier to locate which box truck.

Next Steps

Let me know if you need help getting your Fixed Assets inside of Business Central. If you’re currently living in Excel and just recording balances into BC we can fix that. The FA module in Business Central is really easy to use and can save you hours each close to have this automated.