Canadian Tax Part 6: GST/HST On The Canadian Localization

If you’re on the Canadian localization, and not a US one, you can extract a file for GST/HST.

Setups

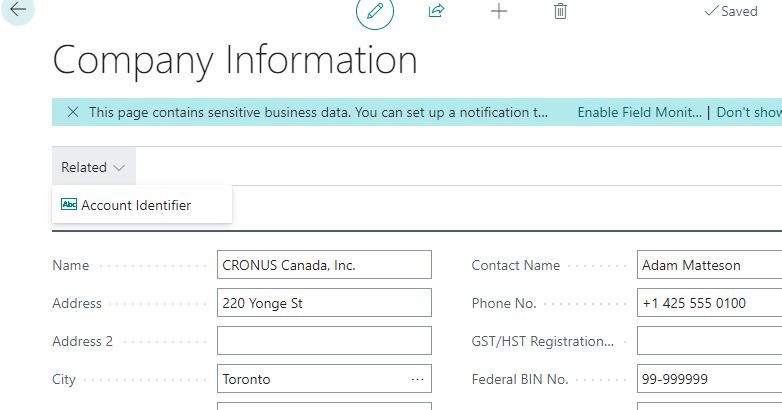

Under the Company Information ensure you have the GST/HST Registration number populated.

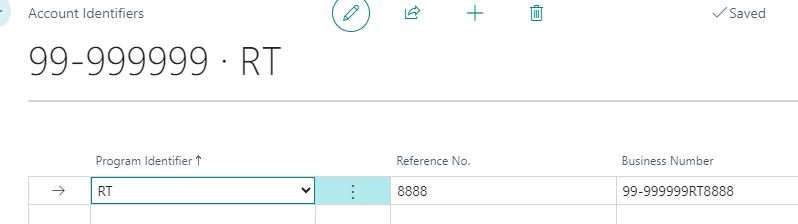

Then under Related >> Account Identifiers; select the proper program and Reference No. The Business Number will then complete itself using the GST/HST Registration Number and the Reference No.

You can add different lines for different programs, RT is the one specifically need for GST Reporting.

GST/HST File Export

Search for GST/HST Internet File Transfer

Enter the requirements such as which dates this is for.

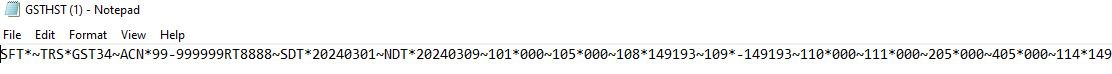

A download will appear, this can be opened in Notepad. Import this to the CRA site.

The only feedback I’ve gotten is verification of these numbers, there’s no solid report for this.

If you’re GL accounts are setup in a way to report out Provincial vs GST vs Input Credits you should be able to make a financial report in the layout of the GST return. Or just use a net change posting date filter on the Chart of Accounts.