Avalara: Business Central Sales Credit Memos

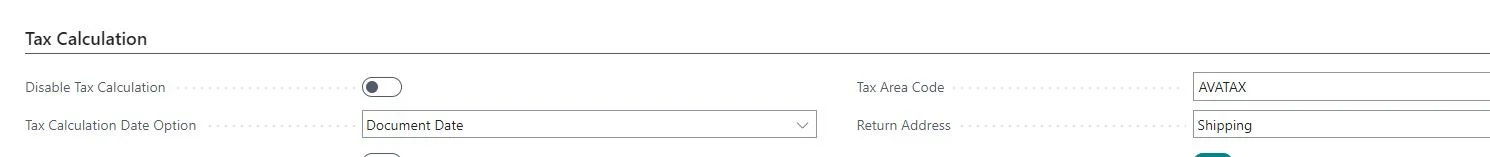

Avalara Configuration

First, in your Avalara Avatax Configuration you have three options for your Sales Returns on the field Return Address.

Shipping - this is default and the recommended value

Invoice

Customer

Note: Invoice and Customer for me have always kind of led to the same thing, which is the Billing address.

Should You Read On:

If one of these or both of these are your process you don’t need the rest of this article:

1) You only use Corrective Credit Memos from the Posted Sales Invoice

2) If you don’t use Ship-to Addresses your setup for Avalara should be Customer not Shipping.

Flow/Problem

For my example I have a customer who is in MI for their billing address, they are drop shipping to NY, coming from my warehouse in OH.

On the sales order/invoice this works great, origin is OH and destination is NY. The customer has been charged NY tax.

On the credit memo:

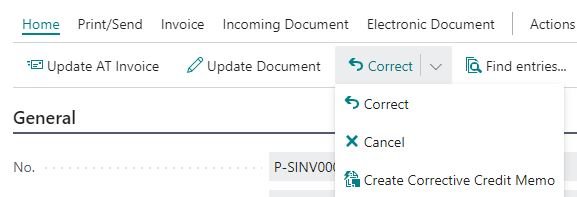

1) If you use Shipping, and you create a corrective credit memo from the Posted Sales Invoice, it will use the customers NY address. Avalara is keying off of the Ship-to Code on the Sales Credit Memo.

Creating a corrective credit memo from the posted invoice

Ship to Code on the Sales Credit Memo when using a Corrective Credit Memo

Now where it falls apart:

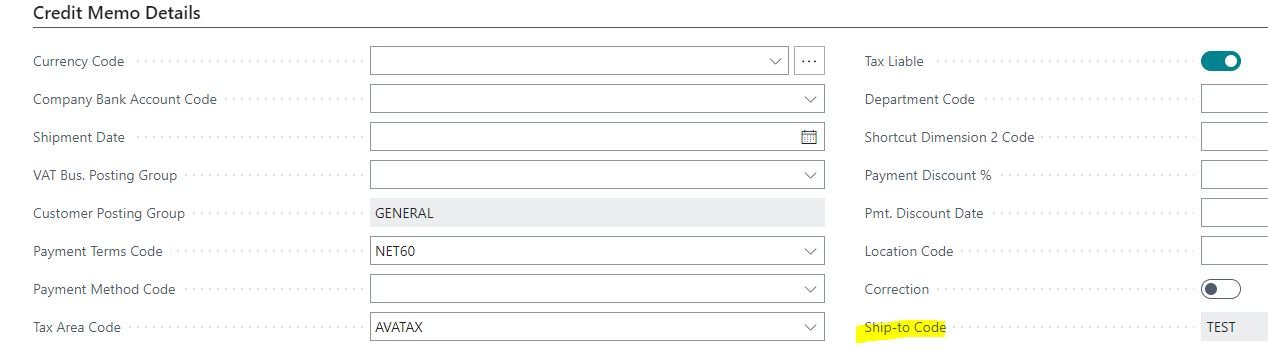

2) If you don’t create a corrective credit memo, and instead make an RMA or make a SCM (possibly importing the lines); that ship-to code is not filled out and you cannot edit it.

As a result, Avalara uses, drum roll…your location address. Your location address is the ship-to address. Now, you’re thinking okay I’ll change that to the customer address, but don’t forget that shows on your SCM as the return address for your customer. I.e. Avalara, is picking up OH tax. I’ve sold at NY tax, and refunding OH tax.

AHHHHH - this is where you scream into the void for a moment.

Screaming into the void

Which then you could use invoice or customer; but that picks up billing, and my billing address is MI.

So right now, I can either change my process, or refund the incorrect tax - or at least that was your options! I have news!

Correcting the Issue

Please note, I am on BC SaaS latest version and on a newer version of Avalara. If you are on-prem, in NAV or on an old Avatax this might not work for you.

First, go back into your Avalara Avatax Configuration. Under Tax Calculation, enable To enable “Applies-to Doc. No” on transaction li…. and have Shipping as your Return Address.

Next on a sales credit memo that is NOT on a Corrective Credit Memo; generate the SCM or SRO as you normally would; be it you pulled in the lines using Get Posted Document Lines to Reverse.. or manually entered the lines.

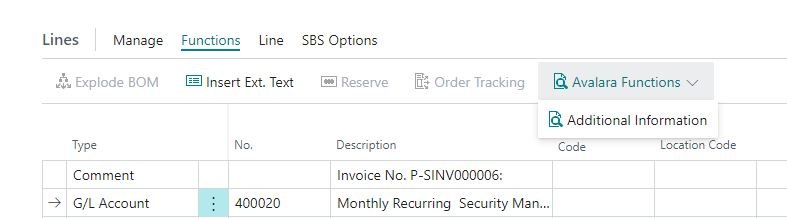

Then on each line (sorry this is going to be an each line thing) while the order is in Open status.

Go to Lines >> Functions >> Avalara Functions>> Additional Information

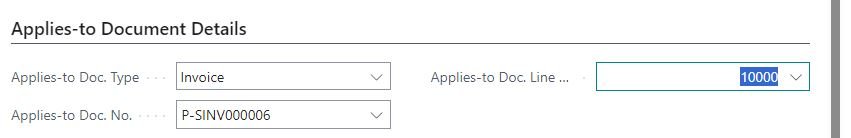

Then select under applies-to doc type: Invoice

Applies-to Doc No.: the invoice you’re associating this line with

Applies-to Doc Line…: which line on the invoice

Note: to appear on the screen, it must be 100% identical, like did you use a GL Account, has to be that exact gl account, did you use an Item? Must be that Item. No generic returns, or returning to an item that is like a warranty sku so you can separate them from your normal skus. It will be blank if there’s no line that matches your line on the SCM/SRO.

Now we’ll see at the bottom the Destination Address has changed to be the address from the original order, the NY address. Origin is our OH warehouse.

Please note this address is not a customers address, it’s a large skyscraper in NY called Solow Residential

This now is applying the NY tax for the refund despite the missing Ship-to code and no other information on the SCM/SRO alluding to this being NY. Just don’t forget if this is multi-line you must do for each line. Otherwise, the other lines could pick up the incorrect tax. I haven’t played with each one going to different drop-ship addresses, most people in BC don’t mix things like that - however, I think there’s a potential here you could refund different tax rates per line.

Do I love this?

Personally, no, I rather ship-to code be editable, I find this to be too many clicks and probably easily forgotten. Note: the user if not making a corrective credit memo would in some way need to update something, so easily forgotten could be true in any solution provided.

However, I’ll take it. This is an improvement to change process and never getting to use an RMA or your S.O.L, or worse, refunding tax incorrectly (maybe in the customers favor) and taking credits from the wrong states.

Also quick thought, all software is going to have things you love/hate or that doesn’t make sense. Even my love of BC I still scratch my head on several functionalities, it doesn’t ruin the love just makes things interesting.