Canadian Purchase Tax Vendor is Incorrect with a Canadian Localization Part 5

Now the first four parts of the series really dived into how you would setup Canadian tax and the localization in both didn’t matter. Some of the example was done in a US Localization and others in a CAN Localization.

We ended part 3 with Avalara was the answer because there was no way on a purchase invoice to accrue sales tax. Avalara can do other things like tax return filings, but if you’re operating in the Canadian localization the must have element of Avalara goes away.

First, create the purchase document like normal; assumption here the vendor has ONLY charged you GST tax so you’re needing to self-asses or accrue and remit payment for the remainder of the tax - so in this case that remainder is nonrecoverable (if recoverable no point to self-asses) and most likely something like the PST tax.

Purchase Invoice Setup

On the Purchase Invoice/Purchase Order, if you are trying to pay the vendor the dollar amount + GST, but they have failed to charge you the proper PST tax.

First, you must have a Tax Area that is ONLY the PST, or other tax rate that is combined with GST to equal the full rate. I.e. Most of the setups to date had a Tax Area of BC, which combined the GST and the PST. In this case we want a tax area of BC ONLY.

Now on the purchase document, on the Header/Lines for Tax Area = GST

Then on Provincial Tax Area on Header and Lines (not header does NOT update the line, and to make it more annoying it doesn’t come over from the vendor card) you want to enter: BC ONLY

Canadian Localization Provincial Tax Area Code Purchase Document

Pop-Up after you select the Provincial Tax Area

The GL accounts after you post, $300 for the goods, $15 for GST; due to Vendor = $315; $21 accrual for PST and the total office supplies (since this wasn’t listed as recoverable for the GST) = $336

Now you can pull this on the Tax Ledger Entries or VAT Ledger Entries depending on your language setup. Then filter out to view the Tax Jursdiction so you can properly file to PST tax authorities.

Sales Tax Journal As Backup

These aren’t commonly used in US tax, and even then in the US Localization this is a bit short sided vs what we start to see in the Canadian localization.

The entry is one side the expense (I choose the same as my entry but you could make this a generic account) and the other side is the Balance Sheet accrual account.

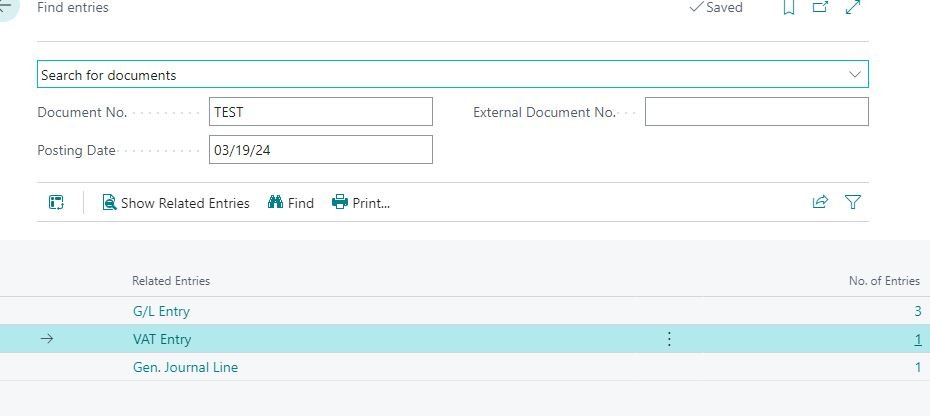

The G/L Entry table for the sales tax journal

Off to a great start right? It allows us to self-asses the tax; it’s not related to an entry but this does hit the tax tables and that’s great.

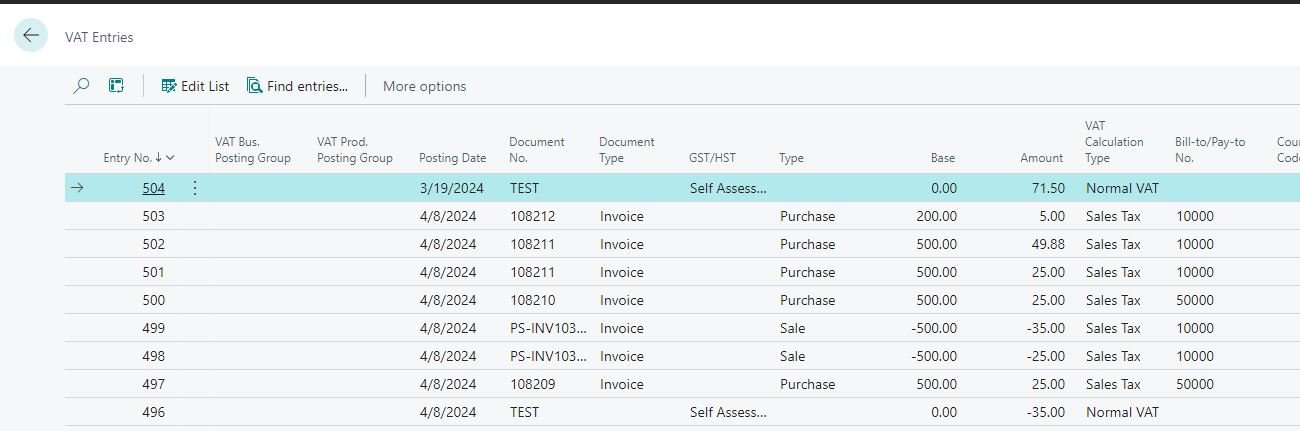

However, it’s hitting the VAT Entries…not Sales Tax Entries. Which even if you update your language isn’t the exact location we love here.

What I’m not loving the sales tax journal:

1) You have to know the amount and calculate the amount yourself

2) There’s no field to switch this from “Normal Tax” to “Sales Tax” so this might populate differently

3) There’s a related portion on the sales tax journal, it doesn’t do anything - so you’re only seeing the self-assessed tax and not the original invoice amount

4) It doesn’t tell you who it was for…like no record to say this was BC ONLY or GST etc…making this silly but you can use the filter.

However, unlike with a general journal to do this entry which would have to be the US based solution, at least here this appears on your VAT Entries along with the invoice amounts. Here you can see the Normal VAT vs Sales Tax as it’s Calculation Type.