Business Central Open Cash Documents On Go-Live, Part 1

Zoe hard at work

What is Open Cash?

Open cash are amounts left after reconciliation of your bank account; these amounts are generally the difference between your G/L Account for the bank account and what the bank shows as your cash balance. These variances can come from:

Undeposited checks - the most common

Undeposited outgoing Wires/ACHs

Incoming deposits ACH/Wire/Check that were recorded but then maybe didn’t hit when it was posted. I.e. you got a check 12/30 and marked paid in your system, but the bank didn’t receive the funds until 1/2.

Prep For Go Live

Cash on go-live can be a tricky beast. The best thing you can do is prepare cash for the go-live to avoid having to do a lot of cash clean-up transactions in the new system.

One thing for sure is that checks expire legally after 180 days. Your checks may even say void after 90 days, but 180 is the max a bank would accept a check. This means that if you import open checks from 2016, no one can cash them. It’s better to fix it in your current system than in your new Business Central environment. Plus, there’s most likely a problem. If someone hasn’t cashed the check by around 30 days after it was sent, they most likely don’t have it. Often aging checks fly under the radar because AP cuts checks and recons are normally performed by someone else, and the two don’t communicate about potential issues.

Same goes if you have deposits that are aged, in general these should hit your bank account within 1-3 business days.

Handling an aging payment?

You have four options:

You talk to the vendor, find out the proper billing, void and un-apply, and re-issue the check in your current system:

When you void/un-apply, it increases your cash, increases your AP

Then you recut the check like new, releasing that liability and decreasing cash. This is all systems go, normal flow.

You find out it wasn’t cashed because it was duplicated/returned or in some other way not necessary to be paid. In this case you would void and un-apply but then use a credit memo to clear the liability against the same accounts it was originally billed. Apply the credit memo against the open AP document.

You can void and not un-apply; however, this method leaves the cash on the vendor’s account. It creates a liability, just not a liability attached to a specific document. Your old document shows closed; a new document for the void is opened (or at least a NAV/BC handles it that way).

You move it to a liability to unclaimed funds.

Sadly, this isn’t just free money back to you. It must be reissued in some way or clear that this liability is not a liability.

Importing Open Cash Into Business Central

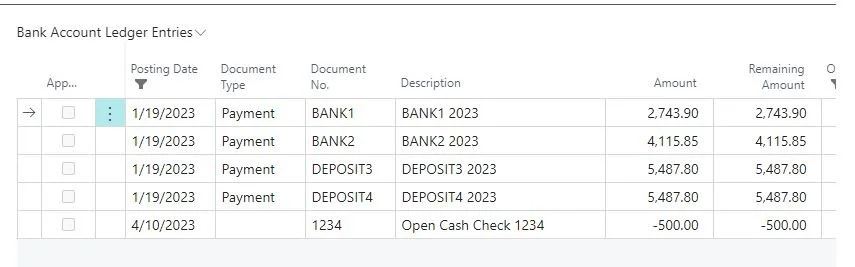

On a go-live, what’s imported is a document that will go in and out of your cash G/L Account. Their purpose is to build your subledger to match your General Ledger Balance for that account; the ending statement balances is also brought over in the same fashion.

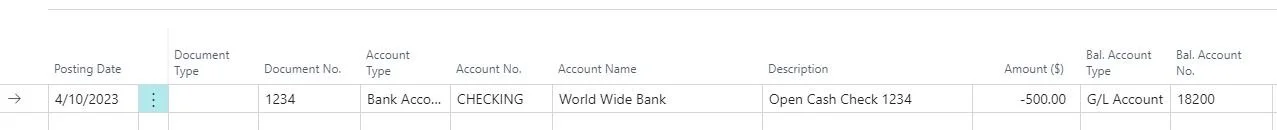

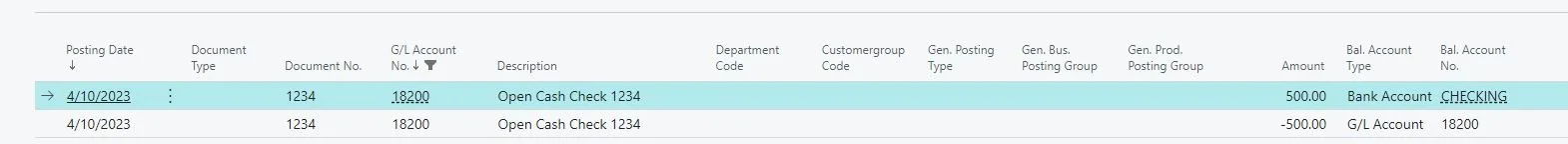

Business Central Open Cash Entry for a Check; 18200 is the same account as the checking account posting group in Cronus

Timing of Open Cash:

If you go live on the 1st of a month, I normally advise you should perform your bank reconciliation in your old system, and then bring over open cash. Timing would be more or less anytime before you must do your next bank recon. Jan go live, would mean sometime before early Feb you should import open cash. If you go live 1/1 and bring open cash right away; the open is most likely all open things for Dec as well.

If you go live mid-month you must bring over open cash as of the last month-end and all transactions incoming and outgoing for that mid-month date.

The catch:

These are for bank reconciliation only; they hold no other purpose

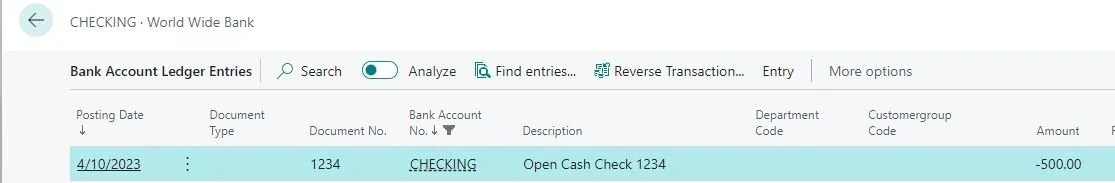

They go one side against the GL Account for cash, and the other is the Bank Account Ledger entries

These are not checks and cannot be voided as they are NOT on your check ledger entries (reversed, yes, voided, no)

They aren’t associated with the vendor, more or less document(s) associated with that vendor.

Business Central Open Cash Impact on the Balance Sheet

Business Central Impact on Bank Account Ledger Entry

Business Central Bank Recon Open Cash Item

Next Time:

In the next part we will discuss what happens if you do bring in an open cash item and find out later it does need voided.