Smooth Out Rounding Variances: Easy Adjustments for Tax/VAT in Business Central

To start off I will say this is most likely going to be used when you have an import of tax that could result in rounding. Example: You have an outside ecommerce system that calculates vat/tax and then sends that tax into BC and you want BC to recalculate that tax to use BC features for tax submission. Now technically speaking you could use this other times for other rounding issues.

Now this is for out of box Business Central tax (no tax add-on software) and I’m using the latest SaaS version and I’m unsure what versions this is available on.

Setups

In the Sales & Receivable Setup - select Allow VAT Differences (in the US/Canadian localization it will be Allow Tax Difference)

Business Central Sales & Receivable Setup screen

In General Ledger Setup set a Max .Vat Difference Allowed (in the US/Canadian localization it will be Max. Tax Difference) - this could be 0.01 or 0.10 depending on what you feel is best.

Business Central General Ledger Setup (this is on a GB localization, but this works for US)

Using on a Sales Document for VAT Environments

On the Sales documents that has the tax calculated but incorrectly go to Invoice >> Statistics; then under lines you can adjust the VAT Amount based on that actual VAT amount or up until the Max VAT Difference Allowed set on General Ledger Setup.

The invoice prior to the change

Updating the VAT Amount under Statistics

Invoice VAT amount after change

Using on the US/Canada Sales Document

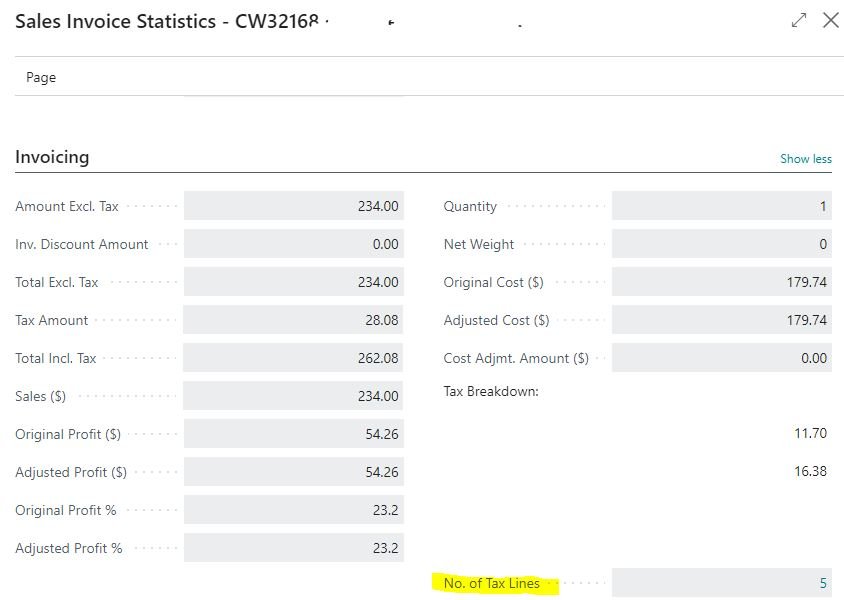

Besides language differences from VAT to just Tax, when you go to Statistics, under the Invoicing fasttab - click on No. of Tax Lines

Business Central Statistics in US/Canada

Now you can change the Tax Amount on a per line that is the incorrect taxing authority - since in the US and Canada there’s normally city/providence and State/GST.

Updating Tax Amount in US/Canada

Post as normal and the changes will come through to your Tax Entries, VAT entries, Sales Tax Collected Reports or however you get your Business Central tax reporting.